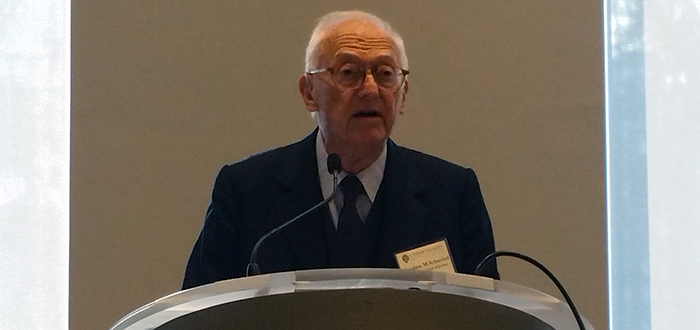

Regressive proposals among the European Union and other governmental bodies to replace investor-state arbitration with an international investment court would lower the wealth of the world, Hon. Stephen M. Schwebel warned during his keynote address at Fordham Law School’s 10th Annual Conference on International Arbitration and Mediation.

The academics, union members, and environmentalists, among others, who criticize treaties allowing investors to negotiate terms with individual states might be well-meaning, according to the former International Court of Justice president and judge, but their views are still “largely and profoundly wrong.” Globally, 2,600 bilateral treaties exist today.

“As a result of this manufactured uproar toward bilateral treaties we could enter into an era of sterile confrontation toward foreign investment,” Schwebel said, noting support for an international investment court would not be easily achieved, if at all.

Directed by Arthur W. Rovine, the conference featured four panels featuring domestic and international experts addressing topics such as investor-state arbitration, innovations in international arbitration, the confluence of EU law and international arbitration, and corporate issues.

Schwebel’s speech followed an Investor-State Arbitration panel in which Washington and Lee University Professor Susan D. Franck reported that, contrary to popular belief, states win these arbitration cases more often than not against investors.

“A lot of the cases investors bring are fading at the jurisdictional stage or falling away because investors realize the case doesn’t have legs,” explained Nicholas Fletcher, an independent arbitrator for Four New Square in England.

Yet despite this win-loss ratio, arbitrator Klaus Reichert noted, Germans, for instance, continue to scapegoat international arbitrators and international arbitration, as harmful to their country.

“Nobody is coming to help us because we are not a popular group,” conceded Reichart, who works for Brick Court Chambers in London.

Whereas there is confusion in the public arena about arbitration results, there is also confusion among practitioners and judges when it comes to when to determine lack of jurisdiction and a motion to dismiss in these cases internationally, said Edward G. Kehoe, partner and co-head of international arbitration practice for King & Spalding.

“Because they are misunderstood, that has led to some inefficient international arbitrations,” Kehoe said. He expressed hope the decision in Renco Corp v. Peru would make the distinction between a motion to dismiss (a legally hopeless claim) and a lack of jurisdiction (whether the plaintiff has a right to be in court at all) easier in the future.

Prior to the Investor-State Arbitration panel, William (Rusty) Park, Professor of Law at Boston University Law School, spoke during a panel on Innovations in International Arbitration about “soft law,” which included discussion of the International Bar Association’s guidelines on the taking of evidence, on conflicts, and on party representation, and their significance for international arbitration.

During the afternoon session, Fordham Law Professor Thomas H. Lee spoke on international arbitration of patent infringement and validity claims. Fordham Law Adjunct Professors Hon. William G. Bassler and Josefa Sicard-Mirabal presented on emergency relief and precedential value of international arbitral awards, respectively, during the morning session.

The ABA Section of International Law and American Society of International Law co-sponsored the conference.

–Ray Legendre