The National Center for Access to Justice (NCAJ) at Fordham Law School has announced the release of the Consumer Debt Litigation Index, an online resource that shows some progress toward adoption of fairer laws but ultimately demonstrates that every U.S. state and the District of Columbia still lack essential legal standards to protect consumers from wrongful, abusive debt collection tactics.

Millions of Americans each year face lawsuits brought by debt collectors. These cases clog court systems, in some districts approaching or exceeding half the number of cases filed in some jurisdictions. Because of ineffective state laws, cases are often filed on bogus or stale debts, against the wrong people, and/or for inflated amounts. Moreover, people often are not even informed they are being sued, are prevented from responding by overly complex legal requirements, or are unable to respond because they can’t afford a filing fee. Very few people sued by debt collectors can hire a lawyer, and in some jurisdictions, the debt collector wins by default in more than 70% of cases because the consumer never responds or appears in court.

David Udell, NCAJ’s executive director, observed that “Consumer debt litigation has become a well known policy scourge in which a relatively small number of collection companies purchase massive amounts of debt for pennies on the dollar, sue millions of people across the country in the expectation of obtaining default judgments, and then garnish wages from individuals don’t learn of the peril until their wages have been seized.”

Better laws can make collection lawsuits fairer for consumers and still provide a path for creditors with valid claims to get repaid. However, the findings in the new Consumer Debt Litigation Index—which looked at 24 policy benchmarks critical to making consumer debt litigation more just and fair—reveal a legal landscape with substantial room for improvement. According to the index, 30 states still allow for debtor’s prisons relying on a loophole that allows their judges to send people to jail for failure to obey a court order to pay debt. In addition, 15 states still charge a fee to answer a consumer debt complaint, and seven states still allow seizure of wages and property without a court order.

“There are four basic principles underlying the Consumer Debt Litigation Index,” said Lauren Jones, NCAJ’s director of law and policy. “First, in too many cases people never even get notice that they are being sued, and, if they do, they have no idea how to proceed. People should be notified of a lawsuit and where they can find help. Second, to prevent bogus lawsuits, creditors should be required to produce evidence that a debt claim is valid. Third, fees, interest, and garnishment should be limited so that lawsuits do not render people destitute. And, finally, debtor’s prison must be eliminated once and for all.”

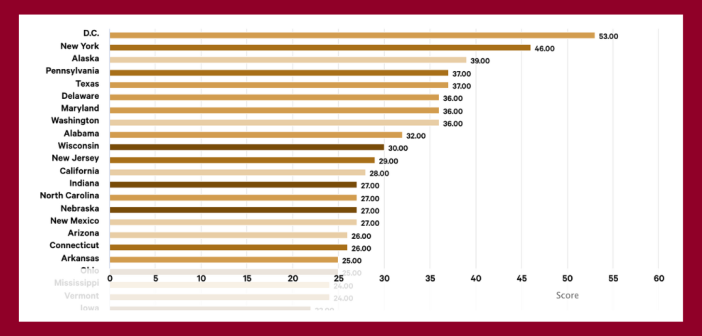

The Report that accompanies the release of the Index observes that although some states are making progress (indeed, only two of the recommended policies had not been adopted by any state), none are doing well (the highest score was only a 53 out of 100), and there is room for improvement in every state. The Index also contains a set of State Reports outlining each state’s results with respect to each of the 24 policy benchmarks.

“We are seeing that simple changes in the law can produce a markedly fairer legal landscape,” added Udell. “Legal reforms can reduce the number of unjust lawsuits filed, increase the opportunity for people to learn they have been sued and defend themselves effectively, and stem the flow of adverse judgments that lead to unjust wage garnishment, arrest and incarceration. We are heartened to see that almost every one of the 24 policy solutions we identified as critical is already in place in at least one state. This means that states seeking to improve need not reinvent the wheel. Rather, they can quickly and easily learn what adjacent states and comparable states are already doing to create a fairer, more just system.”