The spike in bond yields in late February[1] sparked all of Wall Street to put forth its favorite “in hindsight” explanations as to the cause. Reasons cited have ranged from stronger economic growth as the country reopens[2]–to an increase in inflation expectations.[3] However, a minor component of the regulatory framework for the U.S. Treasury market, the Supplementary Leverage Ratio (“SLR”), has only garnered small attention; although, the SLR may be a significant factor contributing to the outsized move in yields.[4]

The SLR is part of the Basel III framework and is intended to set a required amount of Tier 1 capital banks must hold on their balance sheets relative to leverage exposure.[5] The largest banks globally must maintain an SLR of 5%.[6]

During the heat of the pandemic in March 2020, when financial markets were stressed, the Federal Reserve (the “Fed”) temporarily relaxed the SLR requirement in order to enhance liquidity conditions in the market.[7] At the time, the Fed stated: “Liquidity conditions in Treasury markets have deteriorated rapidly, and financial institutions are receiving significant inflows of customer deposits along with increased reserve levels.”[8]

The rule change allowed banks to exempt U.S. treasury bonds and deposits held at the Fed from the calculation of their supplementary leverage ratios.[9] By reducing the burden the SLR imposed on big banks, the Fed was incentivizing these institutions to expand their balance sheets and keep lending to big corporations and small businesses throughout the U.S. economy.[10]

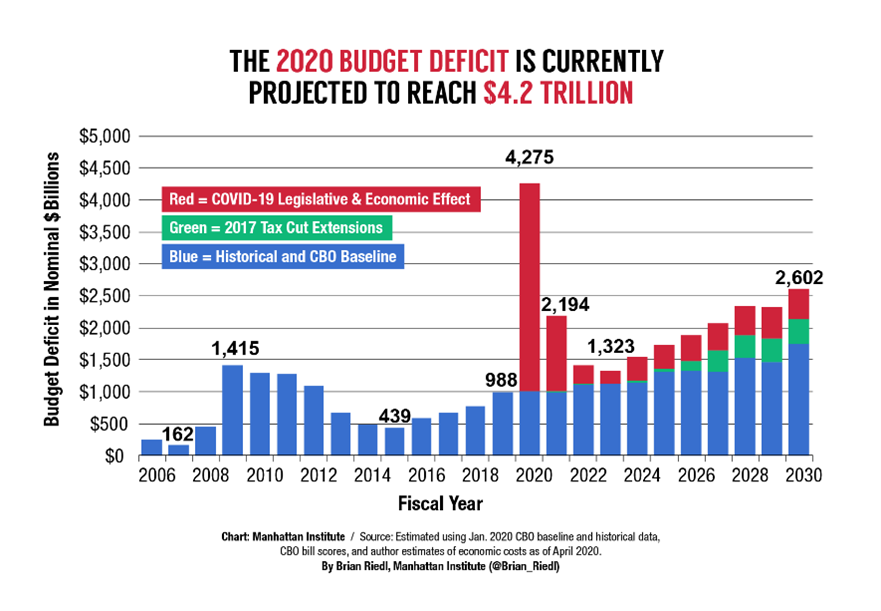

However, this exemption is set to expire shortly – on March 31, 2021.[11] This brings me back to the spike in bond yields that occurred. Removing the temporary exemption of U.S treasuries from the SLR calculation, all else being equal, means major banks have less of an appetite to hold treasury bonds on their balance sheets.[12] And given the increased treasury issuance (more supply) throughout 2020 and into 2021 due to pandemic related stimulus packages (Figure 1),[13] for interest rates to remain at pre-pandemic levels, demand for these bonds must increase.[14] But given the uncertainty surrounding the extension of the SLR exemption, some have concluded that the rise in yields was due to a reluctance by banks to hold U.S. treasuries on their balance sheets or facilitate trading between buyers and sellers in the Treasury market.[15]

Figure 1:

Source: Brian Riedl, Manhattan Institute

So where do we go from here? The Fed has a meeting on March 17th, where Chairman Powell should give a strong indication on the Fed’s intention for the SLR exemption.[16] Although he remained quiet on the subject during his congressional testimony,[17] many commentators believe he will follow the recommendation of the Treasury Borrowing Advisory Committee, which gave a full throated endorsement for extending the SLR exemption.[18] Moreover, Bill Dudley, former Vice Chair of the Federal Open Market Committee and former head of the New York Federal Reserve, also wrote an editorial last week advocating for the exemption to be extended to ensure the smooth functioning of markets.[19] Nevertheless, Chairman Powell also faces dissenters of this view in Congress, where leaders of the Senate Banking Committee have voiced strong opposition to any relaxation of capital rules for big banks.[20]

Overall, while mainstream commentators have discussed the movement of bond yields in terms of economic growth and inflation expectations, uncertainty around an unknown aspect of banking regulation, the SLR, might’ve been exasperating, or even causing these market moves. It is certainly worth keeping an eye on.

[1] Jesse Pound & Vicky McKeever, 10-year yield jumps to a one-year high of 1.6%, a rapid move unnerving investors, CNBC (Feb. 25, 2021), https://www.cnbc.com/2021/02/25/us-bonds-treasury-yields-rise-ahead-of-fourth-quarter-gdp-update.html.

[2] Eustance Huang, JPMorgan says rising bond yields are ‘healthy signs’ and may benefit Asia, CNBC (Feb. 24, 2021), https://www.cnbc.com/2021/02/24/jpmorgan-rising-bond-yields-are-healthy-signs-may-boost-asia-markets.html.

[3] Carla Mozée, Treasury yields spike to highest in over a year as investors weigh inflation concerns against recovery prospects, Bus. Insider (Feb. 25, 2021), https://markets.businessinsider.com/news/stocks/treasury-yields-investors-inflation-recovery-prospects-2021-2-1030125783.

[4] See Alex Harris, Pozsar Says Fed Has a Way to Help Stop Bludgeoning of Treasuries, Bloomberg (Feb. 26, 2021), https://www.bloomberg.com/news/articles/2021-02-26/pozsar-says-fed-has-a-way-to-help-stop-bludgeoning-of-treasuries.

[5] Supplementary Leverage Ratio, Risk.net, https://www.risk.net/definition/supplementary-leverage-ratio-slr#:~:text=The%20supplementary%20leverage%20ratio%20is,US%20banks%20must%20hold%203%25 (last visited Mar. 4, 2021).

[6] Id.

[7] Alexandra Scaggs, Federal Reserve Temporarily Eases Capital Requirement for Big Banks, Barron’s (Apr. 1, 2020), https://www.barrons.com/articles/federal-reserve-temporarily-lifts-a-capital-requirement-for-big-banks-51585784746.

[8] Id.

[9] See Pete Schroeder, Federal Reserve temporarily eases some bank leverage requirements, Reuters (Apr. 1, 2020), https://www.reuters.com/article/us-health-coronavirus-fed-banks/federal-reserve-temporarily-eases-some-bank-leverage-requirements-idUSKBN21J6VN.

[10] Id.

[11] Harris, supra note 4.

[12] See Darrell Duffie, Why Are Big Banks Offering Less Liquidity To Bond Markets?, Forbes (Mar. 11, 2016), https://www.forbes.com/sites/lbsbusinessstrategyreview/2016/03/11/why-are-big-banks-offering-less-liquidity-to-bond-markets/?sh=29d7184129de.

[13] Brian Riedl, Coronavirus Budget Projections: Escalating Deficits and Debt, Manhattan Inst. (Apr. 29, 2020), https://www.manhattan-institute.org/coronavirus-cbo-budget-deficit-projection.

[14] Anna B. Wroblewska, Bond Prices and Interest Rates, The Motley Fool (Mar. 7, 2017), https://www.fool.com/how-to-invest/2014/07/31/bond-prices-and-interest-rates.aspx (explaining the inverse relationship bond yields have with bond prices. If bond prices go down due to decreased demand, bond yields should rise).

[15] Harris, supra note 4.

[16] Federal Open Market Committee, Bd. of Governors of the Fed. Resrv. Sys., https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm (last visited Mar. 4, 2021).

[17] Mish, Powell Disses Inflation and Ignores Questions From Congress About Leverage, TheStreet (Feb. 24, 2021), https://www.thestreet.com/mishtalk/economics/powell-disses-overheating-and-ignores-questions-from-congress-about-leverage.

[18] See Report to the Secretary of the Treasury from the Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association, U.S. Dep’t of the Treasury (Feb. 3, 2021), https://home.treasury.gov/news/press-releases/jy0018.

[19] Bill Dudley, The Fed May Need to Head Off a Money-Market Mess, Bloomberg (Feb. 25, 2021), https://www.bloomberg.com/opinion/articles/2021-02-25/negative-interest-rates-could-be-trouble-unless-fed-acts?srnd=premium&sref=cv51C53O.

[20] Hannah Lang, Big banks don’t need further relief from capital rule: Warren, Brown, Am. Banker (Mar. 2, 2021), https://www.americanbanker.com/news/big-banks-dont-need-further-relief-from-capital-rule-warren-brown.