Originally introduced on November 13, 2019,[1] the Bill for the “Tax Excessive CEO Pay Act” has recently regained momentum,[2] in the wake of the increased income inequality caused by the Covid-19 pandemic.[3] If approved, the Act will raise the corporate tax rate depending on the reported CEO-to-median worker pay ratio of the company.[4] The increase would spare from 0.5% in case of a 50:1 ratio, to 5% for a 500:1 ratio or higher.[5]

The reliance on tax law for curbing the growth of executive compensation[6] could be seen as the acknowledgement (or the consequence) of a corporate law failure,[7] but to claim this would be a simplification. It is true, as the next paragraphs will briefly show, that several attempts to contain ‘excessive’ executive pay have been made in the past years, with considerable interventions on corporate governance mechanisms. However, these interventions have been primarily functional to the reduction of agency costs rather than to the contrast of high compensation per se.[8] Although the normative reforms went in the direction of limiting rent extraction, the hoped political outcome (a reduction in executive pay) did not in fact realize.[9] Today’s attention to the CEO-to-worker pay ratio shows that the political demand for equality transcends issues of corporate governance, justifying an intervention on compensation considered high per se, and not as the result of executive self-dealings.[10]

The growth of U.S. executive compensation

The Economic Policy Institute (‘EPI’) calculated that from 1978 to 2019, CEO pay based on realized compensation grew by 1167%.[11] This does not compare to the S&P stock market growth (741%), to top 0.1% earnings growth (337% to 2018, the latest data year available), and to the typical worker salary (13.7%).[12]

Turning to the CEO-to-worker pay ratio, a graph contained in the same EPI report shows its volatility in the past twenty years.[13] The ratio collapses after the dot-com bubble and the housing bubble,[14] but is significantly higher today than before the 1990s.

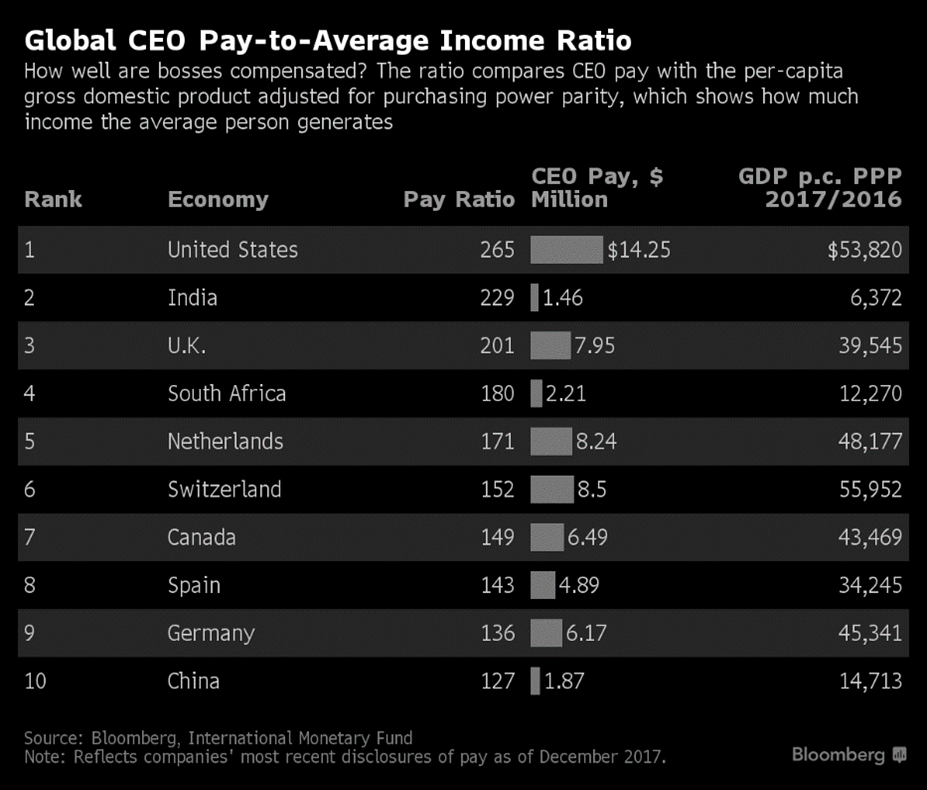

Moreover, American CEOs make significantly more than their foreign colleagues, both in terms of nominal compensation and pay ratio,[15] as shown in the Bloomberg’s table below.

The corporate law perspective

To corporate law, the growth of executive pay is a problem if, and to the extent to, it reflects an expropriation of shareholder value, being a high executive pay not necessarily a problem per se, but a possible negative result of self-dealing.[16] If the CEO sets her own salary, or exercises influence on its determination, then there is a concrete risk that the compensation could represent an instrument for the appropriation of shareholders’ resources that, in the absence of the conflicted interest’s influence, would have not been allocated to her.[17] In this sense, is important to recognize that the executive pay is a potential agency problem in itself,[18] before starting to use it as an instrument to fix the agency problem in the attempt to align directors’ action to shareholder value maximization.[19]

The establishment of Compensation Committees composed of independent directors to insulate pay determination from conflicted influences became mandatory in the rules of the New York Stock Exchange and the NASDAQ.[20] The independent requirements have been progressively strengthened[21] to comply with the rules adopted by the SEC implementing Section 952 of the Dodd-Frank Act.[22] The ban of executive loans introduced by the Sarbanes-Oxley Act and disclosure rules are also instruments aimed at limiting self-dealing.[23]

There is always the risk that directors will do a poor job in setting compensation,[24] triggering a shareholders’ revolt. Furthermore, in selecting the executive from a limited pool of candidates even a non-conflicted Committee could be willing to offer slightly more than the market rate in order to attract a top executive and not lose her to competitors.[25] Letting the shareholders vote on the compensation is a way to ensure that compensation potentially considered ‘excessive’ are agreed on by those whose resources are being deployed. Introduced by the Dodd-Frank Act in 2010, the ‘Say on Pay’—which in the United States is an advisory (non-binding) vote[26]—is a tool designed to allow shareholders to express their dissatisfaction and tackle abnormal levels of CEO pay.[27]

The CEO-to-worker pay ratio

The Dodd-Frank Act also mandates a disclosure of the CEO-to-median-employee ratio.[28] The results of this recently implemented provision are being studied,[29] but research suggests that it does not reduce CEO compensation nor substantially influence investors.[30] The pay ratio can be used simply as a benchmark for calculating the growth in executive pay and rising inequality, as done in the abovementioned EPI report.[31] The pay ratio can also be a vector of information for examples on the agency costs that excessive CEO power imposes on shareholders,[33] and it can generally influence perceptions about the company.[34] However, the pay ratio is not an agency cost itself, given that agency problem arises between the principal (shareholders) and the agent (directors).[35]

Conclusion

To claim that CEOs are paying themselves too much while paying workers too little would misrepresent how CEO compensation is actually set.[36] This vision also negates the efforts made by corporate law to constrain managerial influence on the design of compensation arrangements. To reduce agency costs and tackle rent extraction, corporate law reforms have been aimed at making sure that CEOs do not set up (directly or indirectly) their own salary through influence on captured boards. If the executive salary is produced by market-forces, negotiated at arm’s-length by an insulated and independent Remuneration Committee and approved by shareholders, then the pay hardly hides an agency cost. However, the failure to approve executive compensation that is considered ‘acceptable’ by the general public has attracted more attention from those who look at the problem from the eyes of inequality rather than from the eyes of the agency problem.[37]

Of course, corporate law reforms that tackled executive compensation, such as the Dodd-Frank Act, were aimed at responding to the public outrage,[38] but the normative response primarily did so by focusing on the agency problem, even though the agency problem is only one of the possible explanations of the ‘inflation’ of executive pay.[39] Today, the results of the application of the Say on Pay makes clear that while shareholders are generally content with compensation,[40] the general public is not. The attention to the CEO-to-worker pay ratio (an inequality issue) is consistent with a definition of ‘excessiveness’ as intended by the general public and not by shareholders.

[1] Tax Excessive CEO Pay Act of 2019, S. 2849, 116th Cong. (2019).

[2] See Nicole Goodkind, Bernie Sanders bill would tax companies for CEO pay disparity, Fortune (Mar. 19, 2021, 2:05PM), https://fortune.com/2021/03/19/bernie-sanders-ceo-pay-disparity-corporate-tax; Rachel Lerman, Sanders, Warren reveal bill to tax CEO pay during income inequality hearing targeting Amazon, Wash. Post (Mar. 17, 2021), https://www.washingtonpost.com/technology/2021/03/17/amazon-union-sanders-hearing/.

[3] See Valentina Romei, How the pandemic is worsening inequality, Fin. Times (Dec. 31, 2020), https://www.ft.com/content/cd075d91-fafa-47c8-a295-85bbd7a36b50.

[4] See Goodkind, supra note 2.

[5] Id.

[6] For example, the Clinton administration in 1993 introduced a $1 million cap on the corporate deductibility of executive pay, later expanded under the Trump administration in 2018. Kevin J. Murphy & Michael C. Jensen, The Politics of Pay: The Unintended Consequences of Regulating Executive Compensation, 2, 4-11 (USC Law, Legal Studies Paper No. 8, 2018); Dylan Matthews, Bill Clinton tried to limit executive pay. Here’s why it didn’t work., Wash. Post (Aug. 16, 2012, 10:17AM), https://www.washingtonpost.com/news/wonk/wp/2012/08/16/bill-clinton-tried-to-limit-executive-pay-heres-why-it-didnt-work/.

[7] See Ran Bi, CEO Pay Mix Changes Following Say on Pay Failures, HLS Forum on Corp. Gov. (Feb. 23, 2019), https://corpgov.law.harvard.edu/2019/02/23/ceo-pay-mix-changes-following-say-on-pay-failures/.

[8] For a general overview of the problem of rent extraction in executive compensation, see Lucian A. Bebchuk et al., Managerial Power and Rent Extraction in the Design of Executive Compensation, 69(3) U. Chi. L. Rev. 751 (2002).

[9] See Steven A. Bank et al., Executive Pay: What Worked? (UCLA Law-Econ., Res. Paper No. 11, 2016), https://ssrn.com/abstract=2812349.

[10] See Lerman, supra note 2.

[11] Lawrence Mishel & Jori Kandra, CEO compensation surged 14% in 2019 to $21.3 million, Econ. Pol’y Inst. (Aug. 18, 2020), https://www.epi.org/publication/ceo-compensation-surged-14-in-2019-to-21-3-million-ceos-now-earn-320-times-as-much-as-a-typical-worker/.

[12] Id.

[13] Id.

[14] Jesse Colombo, Why Has The U.S. CEO-To-Worker Pay Ratio Increased So Much?, Forbes (Aug. 31, 2019), https://www.forbes.com/sites/jessecolombo/2019/08/31/why-has-the-u-s-ceo-to-worker-pay-ratio-increased-so-much/.

[15] Ryan Derousseau, Why do American CEOs make twice as much as German CEOs?, Fortune (Nov. 4, 2014), https://fortune.com/2014/11/04/why-do-american-ceos-make-twice-as-much-as-german-ceos/.

[16] “… it is worth emphasizing that the most vocal critics of CEO pay are not shareholders, but rather uninvited guests to the bargaining table who have had no real stake in the companies being managed and no real interest in creating wealth for company shareholders … shareholders are much more concerned about the alignment between pay and performance than the level of pay, and are largely unconcerned when highly performing firms ‘share the wealth’ with their top executives.” Murphy & Jensen, supra note 6, at 2. See Lucian Arye Bebchuk & Jesse M. Fried, Executive Compensation as an Agency Problem, 17(3) J. Econ. Persp. 71 (2003).

[17] Contra Bryce C. Tingle, How Good Are Our “Best Practices” When It Comes to Executive Compensation? A Review of Forty Years of Skyrocketing Pay, Regulation, and the Forces of Good Governance, 80 Sask. L. Rev. 387, 414-415 (2017): “simplistic applications of agency theory may not be the best conceptual framework for approaching executive remuneration. This is heretical, as virtually all discussions of pay, including those on both sides of the pay efficiency question, use simple characterizations of agency theory as a lens for evaluating compensation practices.”

[18] See Bebchuck & Fried, supra note 16.

[19] “While remuneration can be a solution to agency problems, it can also be a source of agency problems.” Michael C. Jensen & Kevin J. Murphy, Remuneration: Where We’ve Been, How We Got to Here, What are the Problems, and How to Fix Them 50 (ECGI Fin., Working Paper No. 44, 2004).

[20] See Murphy & Jensen, supra note 6, at 42.

[21] Id.

[22] Annalisa Barrett, Analysis: Compensation Committee Independence, 21(2) The Corp. Governance Advisor 25, 25 (2003).

[23] See Murphy & Jensen, supra note 6, at 25, 29.

[24] Stephen F. O’Byrne, Say on Pay: Is It Needed? Does it Work?, HLS Forum on Corp. Gov. (Jan. 25, 2018), https://corpgov.law.harvard.edu/2018/01/25/say-on-pay-is-it-needed-does-it-work/.

[25] This problem is linked with the increased transparency of compensation, which can induce a process of mutual imitation. See Joseph Bachelder, Growth in CEO Pay Since 1990, HLS Forum on Corp. Gov. (Sep. 19, 2019), https://corpgov.law.harvard.edu/2018/09/19/growth-in-ceo-pay-since-1990/.

[26] Randall S. Thomas et al., Dodd-Frank’s Say on Pay: Will It Lead to a Greater Role for Shareholders in Corporate Governance?, 97 Cornell L. Rev. 1213, 1224 (2012).

[27] See Jill Fisch et al., Is Say on Pay All About Pay? The Impact of Firm Performance (Eur. Corp. Governance Inst., Working Paper No. 374, 2017), https://ssrn.com/abstract=3046597. See Marinilka B. Kimbro & Danielle Xu, Shareholders have a say in executive compensation: Evidence from say-on-pay in the United States, 35(1) J. Account. Public. Pol. 19 (2016), for the (positive) outcomes of Say on Pay.

[28] In August 2015, the SEC adopted its final rules. See U.S. Sec. Exch. Comm’n, SEC Adopts Rule for Pay Ratio Disclosure (Aug. 5, 2015), https://www.sec.gov/news/pressrelease/2015-160.html.

[29] Wonjae Chang et al., Does Sensationalism Affect Executive Compensation? Evidence from Pay Ratio Disclosure Reform (Dec. 30, 2020), https://ssrn.com/abstract=3470215; Katsiaryna Bardos et al., Entrenchment or Efficiency? CEO-to-Employee Pay Ratio and the Cost of Debt (Feb. 28, 2020), https://ssrn.com/abstract=3766509; Yihui Pan et al., Do Equity Markets Care About Income Inequality? Evidence from Pay Ratio Disclosure (Jan. 15, 2020), https://ssrn.com/abstract=3521020.

[30] Lucas Knust & David Oesch, On the Consequences of Mandatory CEO Pay Ratio Disclosure (Jul. 3, 2020), https://ssrn.com/abstract=3540009.

[31] Mishel & Kandra, supra note 11.

[32] “Proponents of the pay ratio emphasize its ability to help investors evaluate CEO pay levels when exercising voting rights on executive compensation matters such as say-on-pay. Moreover, many suggest that the company-specific metric will allow greater insight into the health of corporations, including the integrity of corporate leaders and the disclosure’s effect on employee morale.” B. Marino, Show Me the Money: The CEO Pay Ratio Disclosure Rule and the Quest for E Quest for Effective Executive Compensation Reform, 85(3) Fordham L. Rev. 1355, 1381-1382 (2016).

[33] See Deniz Anginer et al., Should the CEO Pay Ratio be Regulated?, 45(2) J. Corp. Law Stud. 471 (2020)

[34] See e.g. Khim Kelly & Jean L. Seow, Investor Reactions to Company Disclosure of High CEO Pay and High CEO-to-Employee Pay Ratio: An Experimental Investigation, 28(1) J. Manag. Account. Res. 107 (2016).

[35] See Michael C. Jensen & William H. Meckling, Theory of the firm: Managerial behavior, agency costs and ownership structure, 3(4) J. Financ. Econ. 305 (1976).

[36] The normative evolution aimed at insulating executive pay determination developed after the acknowledgment that rent extraction through CEO compensation was indeed significant, e.g. in John E. Core et al., Corporate governance, chief executive officer compensation, and firm performance, 51(3) J. Fin. Econ. 371 (1999).

[37] See Lerman, supra note 2.

[38] See Murphy & Jensen, supra note 6.

[39] See Randall S. Thomas, Explaining the International CEO Pay Gap: Board Capture or Market Driven?, 57 Vand. L. Rev. 1171 (2004).

[40] See Austin Vanbastelaer et al., 2020 Say on Pay & Proxy Results, Semler Brossy Report (Feb. 4, 2021), https://www.semlerbrossy.com/say-on-pay/2020-say-on-pay-support-was-identical-to-2019-results-and-a-look-at-2020-voting-trends/.